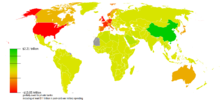

- External debt

-

External debt (or foreign debt) is that part of the total debt in a country that is owed to creditors outside the country. The debtors can be the government, corporations or private households. The debt includes money owed to private commercial banks, other governments, or international financial institutions such as the International Monetary Fund (IMF) and World Bank. Note that the use of gross liability figures greatly distorts the ratio for countries which contain major money centers eg United Kingdom because of London's role as a major money centre. Contrast Net international investment position

Contents

Definition

PEP defines it as "Gross external debt, at any given time, is the outstanding amount of those actual current, and not contingent, liabilities that require payment(s) of principal and/or interest by the debtor at some point(s) in the future and that are owed to nonresidents by residents of an economy".[1]

In this definition, IMF defines the key elements as follows:

- Outstanding and Actual Current Liabilities

- For this purpose, the decisive consideration is whether a creditor owns a claim on the debtor. Here debt liabilities include arrears of both principal and interest.

- Principal and Interest

- When this cost is paid periodically, as commonly occurs, it is known as an interest payment. All other payments of economic value by the debtor to the creditor that reduce the principal amount outstanding are known as principal payments. However, the definition of external debt does not distinguish between whether the payments that are required are principal or interest, or both. Also, the definition does not specify that the timing of the future payments of principal and/or interest need be known for a liability to be classified as debt.

- Residence

- To qualify as external debt, the debt liabilities must be owed by a resident to a nonresident. Residence is determined by where the debtor and creditor have their centers of economic interest—typically, where they are ordinarily located—and not by their nationality.

- Current and Not Contingent

- Contingent liabilities are not included in the definition of external debt. These are defined as arrangements under which one or more conditions must be fulfilled before a financial transaction takes place. However, from the viewpoint of understanding vulnerability, there is analytical interest in the potential impact of contingent liabilities on an economy and on particular institutional sectors, such as government.

Generally external debt is classified into four heads: (1) public and publicly guaranteed debt; (2) private non-guaranteed credits; (3) central bank deposits; and (4) loans due to the IMF. However the exact treatment varies from country to country. For example, while Egypt maintains this four head classification,[2] in India it is classified in seven heads: (a) multilateral, (b) bilateral, (c) IMF loans, (d) Trade Credit, (e) Commercial Borrowings, (f) NRI Deposits,and (g) Rupee Debt, and (h) NPR Debt.

External debt sustainability

Sustainable debt is the level of debt which allows a debtor country to meet its current and future debt service obligations in full, without recourse to further debt relief or rescheduling, avoiding accumulation of arrears, while allowing an acceptable level of economic growth. (UNCTAD/UNDP, 1996)

External-debt-sustainability analysis is generally conducted in the context of medium-term scenarios. These scenarios are numerical evaluations that take account of expectations of the behavior of economic variables and other factors to determine the conditions under which debt and other indicators would stabilize at reasonable levels, the major risks to the economy, and the need and scope for policy adjustment. In these analysis, macroeconomic uncertainties, such as the outlook for the current account, and policy uncertainties, such as for fiscal policy, tend to dominate the medium-term outlook. [IMF, Debt- and Reserve-Related Indicators of External Vulnerability, Policy Paper, 2000]

World Bank and IMF hold that "a country can be said to achieve external debt sustainability if it can meet its current and future external debt service obligations in full, without recourse to debt rescheduling or the accumulation of arrears and without compromising growth". According to these two institutions, "bringing the net present value (NPV) of external public debt down to about 150 percent of a country's exports or 250 percent of a country's revenues" would help eliminating this "critical barrier to longer-term debt sustainability".[3] High external debt is believed to have harmful effects on an economy.[4]

Indicators of external debt sustainability

There are various indicators for determining a sustainable level of external debt. While each has its own advantage and peculiarity to deal with particular situations, there is no unanimous opinion amongst economists as to one sole indicator. These indicators are primarily in the nature of ratios i.e. comparison between two heads and the relation thereon and thus facilitate the policy makers in their external debt management exercise. These indicators can be thought of as measures of the country’s “solvency” in that they consider the stock of debt at certain time in relation to the country’s ability to generate resources to repay the outstanding balance.

Examples of debt burden indicators include the (a) debt to GDP ratio, (b) foreign debt to exports ratio, (c) government debt to current fiscal revenue ratio etc. This set of indicators also covers the structure of the outstanding debt including the (d) share of foreign debt, (e) short-term debt, and (f) concessional debt in the total debt stock.[5]

A second set of indicators focuses on the short-term liquidity requirements of the country with respect to its debt service obligations. These indicators are not only useful early-warning signs of debt service problems, but also highlight the impact of the inter-temporal trade-offs arising from past borrowing decisions. Examples of liquidity monitoring indicators include the (a) debt service to GDP ratio, (b) foreign debt service to exports ratio, (c) government debt service to current fiscal revenue ratio etc. The final indicators are more forward looking as they point out how the debt burden will evolve over time, given the current stock of data and average interest rate. The dynamic ratios show how the debt burden ratios would change in the absence of repayments or new disbursements, indicating the stability of the debt burden. An example of a dynamic ratio is the ratio of the average interest rate on outstanding debt to the growth rate of nominal GDP.[6] · [5] · [7] · [8]

See also

- List of countries by external debt

- Third-world debt

- Odious debt

- Eurodad

- Jubilee Debt Campaign

- Net international investment position

- Internal debt

- Sovereign default

Notes

- ^ "IMF External Debt Statistics. Guide for Compilers and Users", IMF, 2003 (pp. i-xvi & 1-3).

- ^ Central Bank of Egypt "Base Page Information. External Debt Statistics".

- ^ Page 4 in "The Challenge of Maintaining Long-term External Debt Sustainability", World Bank and International Monetary Fund, April 2001, ii +48 pp.

- ^ Bivens, L. Josh (14 December 2004). "US external debt obligations". Debt and the dollar (Economic Policy Institute): p. 2. http://www.epinet.org/Issuebriefs/203/ib203.pdf. Retrieved 2007-07-08.

- ^ a b “Sri Lanka: Borrowing Capacity Assessment”, Asian Development Bank, South Asia Department, Nov. 2003, iv + 30 pp.

- ^ “Part III. Use of External Debt Statistics”, pp. 169-183 in IMF “External Debt Statistics. Guide for Compilers and Users.” IMF, 2003.

- ^ Berensmann, Kathrin “How to ensure debt sustainability beyond the HIPC-Initiative?”, Informal hearings of civil society on financing for development, UN Headquarters, 22 March 2004, 6 pp.

- ^ Chandrasekhar, C.P. and Ghosh, Jayati “The Crisis of State Government Debt’, Macroscan, May 25th, 2005

External links

- IMF National Summary Data Pages (see "External Debt" under "External Sector")

- IMF World Economic Outlook (WEO)-- September 2003 -- Public Debt in Emerging Markets

- External debt list in CIA World Factbook

- IMF Guide to understanding External Debt

- US - External Debt viz Savings rate Comparing External debt viz Savings rate - since 1995 (which are two of the components that finances the Fiscal Policy)

- European Network on Debt and Development reports, news and links on external debt.

Debt Debt instruments Managing debt Bankruptcy · Consolidation · Debt management plan · Debt relief · Debt restructuring · Debt-snowball method · DIP financingDebt collection and evasion Bad debt · Charge-off · Collection agency · Debt bondage · Debt compliance · Debtors' prison · Garnishment · Phantom debt · Strategic default · Tax refund interceptionDebt markets Consumer debt · Corporate debt · Deposit account · Debt buyer · Fixed income · Government debt · Money market · Municipal debt · Securitization · Venture debtDebt in economics Categories:- Debt

- Economic indicators

- Financial economics

- Macroeconomics

Wikimedia Foundation. 2010.