- Eurozone

-

Eurozone (euro area)

Eurozone as of 2011Non-eurozone areas using the euroCurrency euro Union type Economic & Monetary Established 1 January 1999 Members Governance Political control Euro Group Group president Jean-Claude Juncker Issuing authority European Central Bank ECB president Mario Draghi Affiliated with European Union Statistics Population (2011) 331,962,860[1] GDP (2010) €9.2 trillion[2] Interest rate 1.5%[3][4] Inflation 1.6%[5] Unemployment 10%[6] Trade balance €0.9 bn surplus[7] The eurozone (

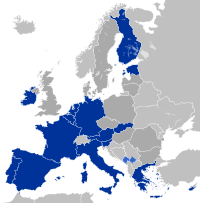

pronunciation (help·info)), officially called the euro area,[8] is an economic and monetary union (EMU) of seventeen European Union (EU) member states that have adopted the euro (€) as their common currency and sole legal tender. The eurozone currently consists of Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. Most other EU states are obliged to join once they meet the criteria to do so. No state has left and there are no provisions to do so or to be expelled.

pronunciation (help·info)), officially called the euro area,[8] is an economic and monetary union (EMU) of seventeen European Union (EU) member states that have adopted the euro (€) as their common currency and sole legal tender. The eurozone currently consists of Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. Most other EU states are obliged to join once they meet the criteria to do so. No state has left and there are no provisions to do so or to be expelled.Monetary policy of the zone is the responsibility of the European Central Bank (ECB) which is governed by a president and a board of the heads of national central banks. The principal task of the ECB is to keep inflation under control. Though there is no common representation, governance or fiscal policy for the currency union, some co-operation does take place through the Euro Group, which makes political decisions regarding the eurozone and the euro. The Euro Group is composed of the finance ministers of eurozone states, however in emergencies, national leaders also form the Euro Group.

Since the late-2000s financial crisis, the eurozone has established and used provisions for granting emergency loans to member states in return for the enactment of economic reforms. The eurozone has also enacted some limited fiscal integration, for example in peer review of each other's national budgets. The issue is highly political and in a state of flux as of 2011 in terms of what further provisions will be agreed for eurozone reform.

On occasion the eurozone is taken to include non-EU members who use the euro as their official currency. Some of these countries, like San Marino, have concluded formal agreements with the EU to use the currency and mint their own coins.[9] Others, like Montenegro, have adopted the euro unilaterally. However, these countries do not formally form part of the eurozone and do not have representation in the ECB or the Euro Group.[10]

Contents

Members

In 1998 eleven European Union member states had met the convergence criteria, and the eurozone came into existence with the official launch of the euro (alongside national currencies) on 1 January 1999. Greece qualified in 2000 and was admitted on 1 January 2001 before physical notes and coins were introduced on 1 January 2002 replacing all national currencies. Between 2007 and 2011, five new states acceded.

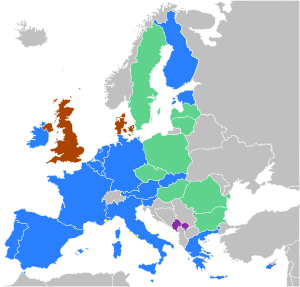

EU Eurozone (17)EU states obliged to join the Eurozone (8)EU state with an opt-out on Eurozone participation (2)

EU Eurozone (17)EU states obliged to join the Eurozone (8)EU state with an opt-out on Eurozone participation (2)State Adopted Population

(Jan. 1, 2011)Nominal GDP

World Bank, 2009Exceptions  Austria

Austria1 January 1999 8,404,252 384,908  Belgium

Belgium1 January 1999 10,918,405 468,522  Cyprus

Cyprus1 January 2008 804,435 24,910  Northern Cyprus[note 1]

Northern Cyprus[note 1] Estonia

Estonia1 January 2011 1,340,194 19,120  Finland

Finland1 January 1999 5,375,276 237,512  France

France1 January 1999 65,075,373 2,649,390  New Caledonia[note 2]

New Caledonia[note 2]

French Polynesia[note 2]

French Polynesia[note 2]

Wallis and Futuna[note 2]

Wallis and Futuna[note 2] Germany

Germany1 January 1999 81,751,602 3,330,032  Greece

Greece1 January 2001 11,325,897 329,924  Ireland

Ireland1 January 1999 4,480,858 227,193  Italy

Italy1 January 1999 60,626,442 2,112,780  Campione d'Italia[note 3]

Campione d'Italia[note 3] Luxembourg

Luxembourg1 January 1999 511,840 52,449  Malta

Malta1 January 2008 417,617 7,449  Netherlands

Netherlands1 January 1999 16,655,799 792,128  Aruba[note 4]

Aruba[note 4]

Curaçao[note 5]

Curaçao[note 5]

Sint Maarten[note 5]

Sint Maarten[note 5]

Caribbean Netherlands[note 6]

Caribbean Netherlands[note 6] Portugal

Portugal1 January 1999 10,636,979 227,676  Slovakia

Slovakia1 January 2009 5,435,273 87,642  Slovenia

Slovenia1 January 2007 2,050,189 48,477  Spain

Spain1 January 1999 46,152,926 1,460,250  Eurozone

Eurozone331,963,357 12,460,362 Enlargement

Main article: Enlargement of the eurozoneTen countries (Bulgaria, the Czech Republic, Denmark, Hungary, Latvia, Lithuania, Poland, Romania, Sweden, and the United Kingdom) are EU members but do not use the euro. Before joining the eurozone, a state must spend two years in the European Exchange Rate Mechanism (ERM II). As of 2011, the National Central Banks (NCBs) of Latvia, Lithuania, and Denmark have participated in ERM II; most remaining currencies are expected to follow soon.

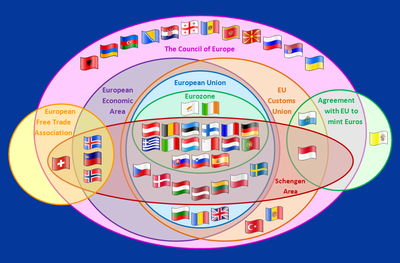

A clickable Euler diagram showing the relationships between various multinational European organisations.v • d • e

Denmark and the United Kingdom obtained special opt-outs in the original Maastricht Treaty. Both countries are legally exempt from joining the eurozone unless their governments decide otherwise, either by parliamentary vote or referendum. Sweden gained a de facto opt-out by using a legal loophole. It is required to join the eurozone as soon as it fulfils the convergence criteria, which include being part of ERM II for two years; joining ERM II is voluntary.[11][12] Sweden has so far decided not to join ERM II.

The 2008 financial crisis increased interest in Denmark and initially in Poland to join the eurozone, and in Iceland to join the European Union, a pre-condition for adopting the euro.[13] Since Latvia requested help from the International Monetary Fund (IMF), as a precondition, it may be forced to drop its currency peg. This would take Latvia out of ERM II and possibly move the euro adoption date even further from 2013 than currently planned.[14] However, by 2010, the debt crisis in the euro zone caused interest from Poland and the Czech Republic to cool.[15]

Non-member usage

Further information: International status and usage of the euroThe euro is also used in countries outside the EU. Three states—Monaco, San Marino, and Vatican City—[16][17] have signed formal agreements with the EU to use the euro and mint their own coins. Nevertheless, they are not considered part of the eurozone by the ECB and do not have a seat in the ECB or Euro Group. Andorra reached a monetary agreement with the EU in June 2011 which will allow it to use the euro as its official currency when ratified. Under the agreement it is intended that Andorra should gain the right to mint its own euro coins as of 1 July 2013, provided that Andorra implements relevant EU legislation.[18]

Some states (viz. Kosovo,[note 7] and Montenegro) officially adopted the euro as their sole currency without an agreement and, therefore, have no issuing rights. These states are not considered part of the eurozone by the ECB. However, in some usage, the term eurozone is applied to all territories that have adopted the euro as their sole currency.[19][20][21] Further unilateral adoption of the euro (euroisation), by both non-euro EU and non-EU members, is opposed by the ECB and EU.[22]

Secession and expulsion

While the eurozone is open to all EU member states to join once they meet the criteria, there is no provision in the EU treaties for a state to leave the eurozone without also leaving the EU as a whole. Likewise there is no provision for a state to be expelled from the euro.[23] However some, including the Dutch government, favour such a provision being created in the event there is a heavily indebted state in the eurozone that refuses to comply with an EU economic reform policy.[24]

However, the benefits of leaving the euro would vary depending on the exact situations. If the replacement currency were expected to devalue, the state would experience a large scale exodus of money, whereas if the currency were expected to appreciate then more money would flow into the economy. A rapidly appreciating currency would be detrimental to the country's exports, however.[25]

Administration and representation

Further information: European Central Bank, Euro Group, and Euro summit Euro Group President Jean-Claude Juncker

Euro Group President Jean-Claude Juncker

The monetary policy of all countries in the eurozone is managed by the European Central Bank (ECB) and the Eurosystem which comprises the ECB and the central banks of the EU states who have joined the euro zone. Countries outside the eurozone are not represented in these institutions. Whereas all EU member states are part of the European System of Central Banks (ESCB). Non EU member states have no say in all three institutions, even those with monetary agreements such as Monaco. The ECB is entitled to authorise the design and printing of euro banknotes and the volume of euro coins minted, and its president is currently Mario Draghi.

The eurozone is represented politically by its finance ministers, known collectively as the Euro Group, and is presided over by a president, currently Jean-Claude Juncker. The finance ministers of the EU member states that use the euro meet a day before a meeting of the Economic and Financial Affairs Council (Ecofin) of the Council of the European Union. The Group is not an official Council formation but when the full EcoFin council votes on matters only affecting the eurozone, only Euro Group members are permitted to vote on it.[26][27][28]

Since the global financial crisis first began in 2008, the Euro Group has met irregularly not as finance ministers, but as heads of state and government (like the European Council). It is in this forum, the Euro summit, that many eurozone reforms have been agreed. French President Nicolas Sarkozy is pushing, as of 2011, for these summits to become regular and twice a year in order for it to be a 'true economic government'.

On 15 April 2008 in Brussels, Juncker suggested that the eurozone should be represented at the International Monetary Fund as a bloc, rather than each member state separately: "It is absurd for those 15 countries not to agree to have a single representation at the IMF. It makes us look absolutely ridiculous. We are regarded as buffoons on the international scene."[29] However Finance Commissioner Joaquín Almunia stated that before there is common representation, a common political agenda should be agreed.[29]

Economy

Comparison table

Comparison of eurozone with other economies, 2006.[30] Population GDP % world Exports Imports eurozone 317 million €8.4 trillion 14.6% 21.7% GDP 20.9% GDP EU (27) 494 million €11.9 trillion 21.0% 14.3% GDP 15.0% GDP United States 300 million €11.2 trillion 19.7% 10.8% GDP 16.6% GDP Japan 128 million €3.5 trillion 6.3% 16.8% GDP 15.3% GDP GDP in PPP, exports/imports as goods and services excluding intra-EU trade. Inflation

HICP figures from the ECB, taken from May of each year:[31]

- 1999: 1.0%

- 2000: 1.7%

- 2001: 3.1%

- 2002: 2.0%

- 2003: 1.8%

- 2004: 2.5%

- 2005: 2.0%

- 2006: 2.5%

- 2007: 1.9%

- 2008: 3.7%

- 2009: 0.0%

- 2010: 1.7%

- 2011: 2.7%

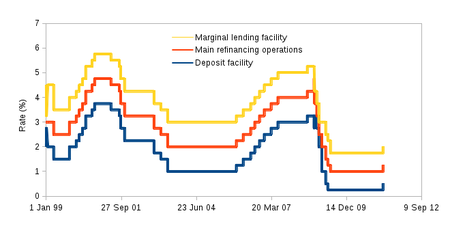

Interest rates

Interest rates for the eurozone, set by the ECB since 1999. Levels are in percentages per annum. Between to June 2000 and October 2008, the main refinancing operations were variable rate tenders, as opposed to fixed rate tenders. The figures indicated in the table from 2000 to 2008 refer to the minimum interest rate at which counterparties may place their bids.[4]

Date Deposit facility Main refinancing operations Marginal lending facility 1 Jan 1999 2.00 3.00 4.50 4 Jan 1999[note 8] 2.75 3.00 3.25 22 Jan 1999 2.00 3.00 4.50 9 Apr 1999 1.50 2.50 3.50 5 Nov 1999 2.00 3.00 4.00 4 Feb 2000 2.25 3.25 4.25 17 Mar 2000 2.50 3.50 4.50 28 Apr 2000 2.75 3.75 4.75 9 Jun 2000 3.25 4.25 5.25 28 Jun 2000 3.25 4.25 5.25 1 Sep 2000 3.50 4.50 5.50 6 Oct 2000 3.75 4.75 5.75 11 May 2001 3.50 4.50 5.50 31 Aug 2001 3.25 4.25 5.25 18 Sep 2001 2.75 3.75 4.75 9 Nov 2001 2.25 3.25 4.25 6 Dec 2002 1.75 2.75 3.75 7 Mar 2003 1.50 2.50 3.50 6 Jun 2003 1.00 2.00 3.00 6 Dec 2005 1.25 2.25 3.25 8 Mar 2006 1.50 2.50 3.50 15 Jun 2006 1.75 2.75 3.75 9 Aug 2006 2.00 3.00 4.00 11 Oct 2006 2.25 3.25 4.25 13 Dec 2006 2.50 3.50 4.50 14 Mar 2007 2.75 3.75 4.75 13 Jun 2007 3.00 4.00 5.00 9 Jul 2008 3.25 4.25 5.25 8 Oct 2008 2.75 4.75 9 Oct 2008 3.25 4.25 15 Oct 2008 3.25 3.75 4.25 12 Nov 2008 2.75 3.25 3.75 10 Dec 2008 2.00 2.50 3.00 21 Jan 2009 1.00 2.00 3.00 11 Mar 2009 0.50 1.50 2.50 8 Apr 2009 0.25 1.25 2.25 13 May 2009 0.25 1.00 1.75 13 April 2011 0.50 1.25 2.00 13 July 2011 0.75 1.50 2.25 9 November 2011 0.50 1.25 2.00 Public debt

The following table states the ratio of public debt to GDP in percent for EU and other selected European states[dated info]. Eurozone and non-eurozone EU members are marked as Euro and EU respectively. The euro convergence criterion is 60 %.

Country CIA 2007[32] OECD 2009[33][34] IMF 2009[35] CIA 2009[36] EuroStat 2010[37]  Austria

Austria59.10 72.7 67.10[38] 66.40 72.3  Belgium

Belgium84.60 100.4 93.70[39] 101.00 96.8  Cyprus

Cyprus59.60 56.20[40] 56.20 60.8  Estonia

Estonia3.40 7.10 6.6  Finland

Finland35.90 52.6 44.00[41] 40.30 48.4  France

France63.90 87.1 78.10[42] 77.60 81.7  Germany

Germany64.90 76.5 72.50[43] 77.20 83.2  Greece

Greece89.50 120.2 113.40 142.8  Ireland

Ireland24.90 72.7 64.00[44] 64.80 96.2  Italy

Italy104.00 127.7 115.8[45] 115.80 119.0  Luxembourg

Luxembourg6.40 18.0 16.40[46] 14.60 18.4  Malta

Malta69.00 68.0  Netherlands

Netherlands45.50 69.4 58.90[47] 60.90 62.7  Portugal

Portugal63.60 86.3 75.80[48] 76.80 93.0  Slovakia

Slovakia35.90 39.8 35.70[49] 35.70 41.0  Slovenia

Slovenia23.60 44.1 31.30 38.0  Spain

Spain36.20 62.4 53.20[50] 53.20 60.1 Fiscal policies

The primary means for fiscal coordination within the EU lies in the Broad Economic Policy Guidelines which are written for every member state, but with particular reference to the 17 current members of the eurozone. These guidelines are not binding, but are intended to represent policy coordination among the EU member states, so as to take into account the linked structures of their economies.

For their mutual assurance and stability of the currency, members of the eurozone have to respect the Stability and Growth Pact, which sets agreed limits on deficits and national debt, with associated sanctions for deviation. The Pact originally set a limit of 3% of GDP for the yearly deficit of all eurozone member states; with fines for any state which exceeded this amount. In 2005, Portugal, Germany, and France had all exceeded this amount, but the Council of Ministers had not voted to fine those states. Subsequently, reforms were adopted to provide more flexibility and ensure that the deficit criteria took into account the economic conditions of the member states, and additional factors.

The Organisation for Economic Co-operation and Development downgraded its economic forecasts on 20 March 2008 for the eurozone for the first half of 2008. Europe does not have room to ease fiscal or monetary policy, the 30-nation group warned. For the euro zone, the OECD now forecasts first-quarter GDP growth of just 0.5%, with no improvement in the second quarter, which is expected to show just a 0.4% gain.

Bailout provisions

See also: History of the euro#Recession eraThe late-2000s financial crisis prompted a number of reforms in the eurozone. One was a u-turn on the eurozone's bailout policy that led to the creation of a specific fund to assist eurozone states in trouble. The European Financial Stability Facility (EFSF) and the European Financial Stability Mechanism (EFSM) were created in 2010 to provide, alongside the International Monetary Fund (IMF), a system and fund to bailout members. However the EFSF and EFSM were temporary, small and lacked a basis in the EU treaties. Therefore, it was agreed in 2011 to establish a European Stability Mechanism (ESM) which would be much larger, funded only by eurozone states (not the EU as a whole as the EFSF/EFSM were) and would have a permanent treaty basis. As a result of that its creation involved agreeing an amendment to TEFU Article 136 allowing for the ESM and a new ESM treaty to detail how the ESM would operate. If both are successfully ratified according to schedule, the ESM would be operation by the time the EFSF/EFSM expire in mid-2013.

Peer review

See also: Euro Plus PactStrong EU oversight in the fields of taxation and budgetary policy and the enforcement mechanisms that go with it have sometimes been described as potential infringements on the sovereignty of eurozone member states[51] However, in June 2010, broad agreement was finally reached on a controversial proposal for member states to peer review each others' budgets prior to their presentation to national parliaments. Although showing the entire budget to each other was opposed by Germany, Sweden and the UK, each government would present to their peers and the Commission their estimates for growth, inflation, revenue and expenditure levels six months before they go to national parliaments. If a country was to run a deficit, they would have to justify it to the rest of the EU while countries with a debt more than 60% of GDP would face greater scrutiny.[52]

The plans would apply to all EU members, not just the eurozone, and have to be approved by EU leaders along with proposals for states to face sanctions before they reach the 3% limit in the Stability and Growth Pact. Poland has criticised the idea of withholding regional funding for those who break the deficit limits, as that would only impact the poorer states.[52] In June 2010 France agreed to back Germany's plan for suspending the voting rights of members who breach the rules.[53] In March 2011 was initiated a new reform of the Stability and Growth Pact aiming at straightening the rules by adopting an automatic procedure for imposing of penalties in case of breaches of either the deficit or the debt rules.[54][55]

See also

Notes

- ^ The self-declared Turkish Republic of Northern Cyprus is not recognised by the EU and uses the Turkish lira. However the euro does circulate widely.

- ^ a b c French Pacific territories use the CFP franc, which is pegged to the euro.

- ^ Uses the Swiss franc. However the euro is also accepted and circulates widely.

- ^ Aruba is part of the Kingdom of the Netherlands, but not the EU. It uses the Aruban florin, which is pegged to the US dollar.

- ^ a b Currently uses the Netherlands Antillean guilder and plans to introduce the Caribbean guilder on 1 January 2012; both are pegged to the US dollar.

- ^ Uses the US Dollar.

- ^ Kosovo is the subject of a territorial dispute between the Republic of Serbia and the self-proclaimed Republic of Kosovo. The latter declared independence on 17 February 2008, while Serbia claims it as part of its own sovereign territory. Its independence is recognised by 85 UN member states.

- ^ The ECB announced on 22 December 1998 that, between 4 and 21 January 1999, there would be a narrow corridor of 50 base points interest rates for the marginal lending facility and the deposit facility in order to help the transition to the ECB's interest regime.

References

- ^ Total population as of 1 January

- ^ Gross domestic product at market prices

- ^ World interest rates table, FX street

- ^ a b Key ECB interest rates, ECB

- ^ HICP – all items – annual average inflation rate Eurostat

- ^ Harmonised unemployment rate by gender – total – [teilm020,; Total % (SA) Eurostat

- ^ For the whole of June 2011. Euroindicators 16 August 2011, Eurostat

- ^ "Countries, languages, currencies". Interinstitutional style guide. the EU Publications Office. http://publications.europa.eu/code/en/en-370300.htm. Retrieved 2 February 2009.

The euro area, European Central Bank - ^ "Agreements on monetary relations (Monaco, San Marino, the Vatican and Andorra)". http://europa.eu/legislation_summaries/economic_and_monetary_affairs/institutional_and_economic_framework/l25040_en.htm. Retrieved 26 May 2010.

- ^ A glossary issued by the ECB defines "euro area", without mention of Monaco, San Marino, or the Vatican.

- ^ "Swedish Parliament EU Information". Swedish Parliament. 4 December 2009. http://www.eu-upplysningen.se/Amnesomraden/EMU/Sverige-och-EMU/. Retrieved 16 January 2010.

- ^ "Information on ERM II". European Commission. 22 December 2009. http://ec.europa.eu/economy_finance/euro/adoption/erm2/index_en.htm. Retrieved 16 January 2010.

- ^ Dougherty, Carter (1 December 2008). "Buffeted by financial crisis, countries seek euro's shelter". The New York Times. http://www.iht.com/articles/2008/12/01/business/euro.php?page=1. Retrieved 2 December 2008.

- ^ "€5bn question is whether IMF will force Latvia to give up currency peg". Business News Europe. http://businessneweurope.eu/storyf1384. Retrieved 3 December 2008.

- ^ "Czechs, Poles cooler to euro as they watch debt crisis". Reuters. 16 June 2010. http://www.reuters.com/article/idUSLDE65F15Z20100616. Retrieved 18 June 2010.

- ^ "Agreements on monetary relations (Monaco, San Marino, the Vatican and Andorra)". European Communities. 30 September 2004. http://europa.eu/scadplus/leg/en/lvb/l25040.htm. Retrieved 12 September 2006.

- ^ "The euro outside the euro area". Europa (web portal). http://ec.europa.eu/economy_finance/euro/world/outside_euro_area/index_en.htm. Retrieved 26 February 2011.

- ^ "Monetary Agreement between the European Union and the Principality of Andorra". 30 June 2011. http://ec.europa.eu/economy_finance/euro/world/outside_euro_area/documents/2011-07-06_agreement_en.pdf. Retrieved 10 September 2011.

- ^ "European Foundation Intelligence Digest". Europeanfoundation.org. http://www.europeanfoundation.org/docs/117id.htm. Retrieved 30 May 2010.

- ^ "Euro used as legal tender in non-EU nations". International Herald Tribune. 1 January 2007. http://www.iht.com/articles/2007/01/01/business/euro.php. Retrieved 22 November 2010.

- ^ "Europe, The eurozone's 13th member". BBC News. 11 December 2001. http://news.bbc.co.uk/1/hi/world/europe/1696122.stm. Retrieved 30 May 2010.

- ^ "Unilateral Euroization By Iceland Comes With Real Costs And Serious Risks". Lawofemu.info. 15 February 2008. http://www.lawofemu.info/blog/2008/02/ecb-unilateral.html. Retrieved 30 May 2010.

- ^ Athanassiou, Phoebus (December 2009) Withdrawal and Expulsion from the EU and EMU, Some Reflections (PDF), European Central Bank. Accessed 8 September 2011

- ^ Phillips, Leigh (7 September 2011) Netherlands: Indebted states must be made ‘wards’ of the commission or leave euro, EU Observer. Accessed 8 September 2011

- ^ Eichengreen, Barry (23 July 2011) Can the Euro Area Hit the Rewind Button? (PDF), University of California. Accessed 8 September 2011

- ^ Treaty of Lisbon (Provisions specific to member states whose currency is the euro), EurLex

- ^ "An economic government for the eurozone?". Federal Union. http://www.fedtrust.co.uk/admin/uploads/FedT_Economic_Government.pdf. Retrieved 26 February 2011.

- ^ Protocols, Official Journal of the European Union

- ^ a b Elitsa Vucheva (15 April 2008). "Eurozone countries should speak with one voice, Juncker says". EU Observer. http://euobserver.com/9/25984. Retrieved 26 February 2011.

- ^ "An international currency". Europa (web portal). http://ec.europa.eu/economy_finance/euro/why/international/index_en.htm. Retrieved 26 February 2011.

- ^ European Central Bank (14 December 2007). "Euro area (changing composition) – HICP – Overall index, Annual rate of change, Eurostat, Neither seasonally or working day adjusted". http://sdw.ecb.europa.eu/quickview.do?SERIES_KEY=122.ICP.M.U2.N.000000.4.ANR. Retrieved 9 September 2011.

- ^ October 2008 "The World Factbook – (Rank Order – Public debt)". Archived from the original on 15 October 2008. http://www.webcitation.org/query?url=https%3A%2F%2Fwww.cia.gov%2Flibrary%2Fpublications%2Fthe-world-factbook%2Frankorder%2F2186rank.html&date=15 October 2008. Retrieved 15 October 2008. (all estimates 2007 data unless noted)

- ^ "Annex Table 33. General government net financial liabilities". 2 January 2011. http://www.oecd.org/dataoecd/5/51/2483816.xls.

- ^ ""Annex Table 32. General government gross financial liabilities" in OECD Economic Outlook". OECD. http://www.oecd.org/document/61/0,3343,en_2649_34573_2483901_1_1_1_1,00.html. Retrieved 2 January 2011. (2009; direct URL of datasheet is OECD.org

- ^ "Report for Selected Countries and Subjects". IMF. http://www.imf.org/external/pubs/ft/weo/2008/02/weodata/weorept.aspx?sy=2004&ey=2009&ssd=1&sort=country&ds=.&br=0&pr1.x=59&pr1.y=16&c=193%2C542%2C122%2C137%2C124%2C181%2C156%2C138%2C423%2C196%2C128%2C142%2C172%2C182%2C132%2C576%2C134%2C961%2C174%2C184%2C532%2C144%2C176%2C146%2C178%2C528%2C436%2C112%2C136%2C111%2C158&s=GGD_NGDP&grp=0&a=. Retrieved 11 December 2008. (General government gross debt 2008 estimates rounded to one decimal place)

- ^ "The World Factbook – (Rank Order – Public debt)". Archived from the original on 2 January 2011. http://www.webcitation.org/5nvfxCBRI. Retrieved 2 January 2011.(all estimates 2009 data unless noted)

- ^ "General government debt". Eurostat. http://epp.eurostat.ec.europa.eu/portal/page/portal/government_finance_statistics/data/main_tables. Retrieved 28 May 2011. (General government gross debt 2009 estimates rounded to one decimal place)

- ^ "IMF.org". IMF.org. http://www.imf.org/external/np/sec/pn/2010/pn10126.htm. Retrieved 18 May 2011.

- ^ "IMF.org". IMF.org. http://www.imf.org/external/np/sec/pn/2010/pn1037.htm. Retrieved 18 May 2011.

- ^ "IMF.org". IMF.org. http://www.imf.org/external/np/sec/pn/2010/pn10123.htm. Retrieved 18 May 2011.

- ^ "IMF.org". IMF.org. http://www.imf.org/external/np/sec/pn/2010/pn10122.htm. Retrieved 18 May 2011.

- ^ "IMF.org". IMF.org. http://www.imf.org/external/np/sec/pn/2010/pn10103.htm. Retrieved 18 May 2011.

- ^ "IMF.org". IMF.org. http://www.imf.org/external/np/sec/pn/2010/pn1044.htm. Retrieved 18 May 2011.

- ^ "IMF.org". IMF.org. http://www.imf.org/external/np/sec/pn/2010/pn1086.htm. Retrieved 18 May 2011.

- ^ "IMF.org". IMF.org. http://www.imf.org/external/np/sec/pn/2010/pn1066.htm. Retrieved 18 May 2011.

- ^ "IMF.org". IMF.org. http://www.imf.org/external/np/sec/pn/2010/pn1070.htm. Retrieved 18 May 2011.

- ^ "Kingdom of the Netherlands—Netherlands: 2009 Article IV Consultation—Staff Report; Staff Statement; Public Information Notice on the Executive Board Discussion; and Statement by the Executive Director for the Kingdom of the Netherlands—Netherlands; IMF Country Report 10/34; December 15, 2009" (PDF). http://www.imf.org/external/pubs/ft/scr/2010/cr1034.pdf. Retrieved 18 May 2011.

- ^ "IMF.org". IMF.org. http://www.imf.org/external/np/sec/pn/2010/pn1008.htm. Retrieved 18 May 2011.

- ^ "IMF.org". IMF.org. http://www.imf.org/external/np/sec/pn/2010/pn10129.htm. Retrieved 18 May 2011.

- ^ "IMF.org". IMF.org. http://www.imf.org/external/np/sec/pn/2010/pn10106.htm. Retrieved 18 May 2011.

- ^ (English) see Ionescu Romeo, "Romania and Greece: Together or Alone", AJBM Vol. 4(19), p. 4197, December 2010 [Quoting Q1 2010 article (in French) by M. Nicolas J. Firzli in Revue Analyse Financière], http://www.academicjournals.org/ajbm/PDF/pdf2010/29Dec/Romeo.pdf, retrieved 29 March 2011

- ^ a b EU agrees controversial peer review of national budgets, EU Observer

- ^ Willis, Andrew (15 June 2010) Merkel: Spain can access aid if needed, EU Observer

- ^ "Council reaches agreement on measures to strengthen economic governance" (PDF). http://www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ecofin/119888.pdf. Retrieved 18 May 2011.

- ^ Jan Strupczewski (15 March 2011). "EU finmins adopt tougher rules against debt, imbalance". Uk.finance.yahoo.com. http://uk.finance.yahoo.com/news/EU-finmins-adopt-tougher-reuters_molt-1023414724.html?x=0. Retrieved 18 May 2011.

External links

- European Central Bank

- Central Bank Rates, ECB Key Rate, chart and data

- European Commission – Economic and Financial Affairs – Eurozone

European Union topics History - Pre-1945

- 1945–1957

- 1958–1972

- 1973–1993

- 1993–2004

- since 2004

Predecessors- European Coal and Steel Community (1951–2002)

- European Economic Community (1958–1993/2009)

- Euratom (1958–present)

- European Communities (1967–1993/2009)

- Justice and Home Affairs (1993–2009)

- Details

Governance - European Banking Authority

- Eurojust

- Europol

- Frontex

- Environment

- Reconstruction

- Disease Prevention and Control

- External Action Service

- Maritime Safety

Politics Law - Acquis

- Competition law

- Copyright law

- Directive

- Journal

- Government procurement

- Four freedoms (Labour mobility)

- Procedure

- Regulation

- Schengen Agreement

- Charter of Fundamental Rights

- Treaties (Opt-outs)

- Enhanced co-operation

- Mechanism for Cooperation and Verification

Geography - Borders

- Extreme points

- Largest municipalities

- Largest urban areas

- Largest metropolitan areas

- Larger Urban Zones

- Member States

- Special territories

- Regions

Economy - Currencies

- Common Agricultural Policy (CAP)

- Common Fisheries Policy

- Budget

- Euro

- Central Bank

- Investment Bank

- Investment Fund

- Eurozone

- Energy

- Regional development

- Single Market

- FTAs

- Solidarity Fund

- Transport (Galileo system)

Culture Lists Theory International reach and expansion of the European Union Theory Reach ACP (Economic Partnership Agreements) · Association Agreement · Free trade agreements · Common Foreign and Security Policy (CFSP) · European Security and Defence Policy (ESDP) (missions) · European Economic Area · Stabilisation and Association Process · Europeanisation · High Representative (Bosnia) · International Civilian Representative (Kosovo)Partnerships Representation Assets Europe Culture Art (Architecture · Capital of Culture · Classical music · Cinema (Film festivals) · Painting · Sculpture) · Cuisine · Etiquette · Literature · Languages (Endangered) · Philosophy · Religion (Christianity · Islam · Judaism) · Sport · Symbols · Universities (Bologna Process · Erasmus)Demographics Ageing · Education · Ethnic groups (Genetic history) · Immigration · Life expectancy · Retirement · PopulationEconomy Geography Sovereign states and dependent territories · Area and population · Cities · Villages · Geology · Islands · Rivers · Lakes · Mountains · Extreme pointsHistory Prehistory · Classical antiquity · Late Antiquity · Middle Ages · Early modernity · Military · Predecessor states · Dates of achieving sovereigntyPolitics International organisations · Integration · CIS · CoE · CSTO · GUAM · NATO · OSCE (statistics) · Post-Soviet · Transatlantic · EurosphereEuropean Union Members (future) · Politics · Visa policy · ENP · Foreign relations · Economic relations (FTAs) · Economy · Eurozone · EEA · EUCU · Schengen · StatisticsOther Communications · Crisis situations and protests · Financial and social rankings · Internet users · Law · Maps · Press Freedom Index · TransportCategories:- Eurozone fiscal matters

Wikimedia Foundation. 2010.